Before we get going on the March Fund Update, a little word from your authors. Typically, we write the Fund update in the final days of each month. Then once we receive our performance numbers from our third-party fund administrator during the first week of the new month, we drop those in, polish up any remaining bits, and hit send.

But this first week of April has been anything but typical. Markets have turned sharply red, and it's been a significant and volatile start to the month. While we considered rewriting this newsletter to reflect the current tone of the market, we ultimately decided to leave it largely unedited—just as it was at the close of March. We believe it’s important to preserve the context and clarity of our thinking as it stood then, and to share our reflections without the benefit of hindsight.

That said, we’re actively navigating these shifts and will continue to do what we’ve always done: focus on process, risk management, and long-term performance despite any bumps along the way.

Now, onto March…

March was another month where patience paid off.

This March, the markets reminded us that fear still holds plenty of sway. Words like recession, tariffs, and slowdown made the rounds on financial news networks, spooking investors and sparking a wave of selling across sectors. Uncertainty was the mood, and many portfolios paid the price of this escalating trade war.

Volatility returned, and uncertainty reigned — but our algo stayed true to its core: Disciplined risk management, selective engagement, and long-term compounding.

It’s easy to feel like you should do something in times like these — shift allocations, chase a bounce, try to catch a falling knife. But our system is designed around a different principle: don’t let the noise dictate your playbook.

Let the data, the signals, and the probabilities do the talking.

Charlie Munger’s words rang loud for us this month: “The big money is not in the buying and selling, but in the waiting.” And that’s exactly what we did — with patience, with discipline, and with risk management top of mind.

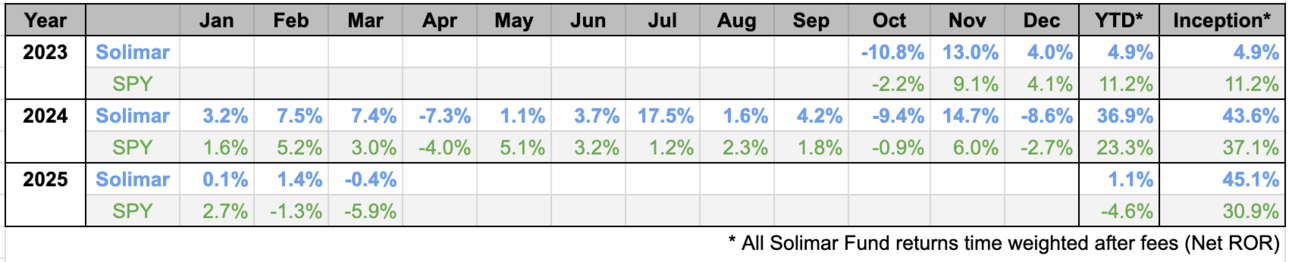

Solimar Fund returned -0.4% after fees in March, outperforming the S&P 500’s -5.9%. We’re now up +1.1% YTD, while the SPY is down -4.6%.

Alpha Bets.

Alpha is a measure of a strategy’s ability to outperform its benchmark — in our case, the S&P 500 (SPY) — after adjusting for market risk. In simple terms, it reflects the value added through skill, not just exposure to rising markets.

In 2024, the S&P 500 surged, powered largely by a small group of mega-cap tech names. It was a tough year for most funds to beat the index, and in that kind of environment, generating alpha often meant simply keeping up. We returned 36.9% after fees vs. the SPY’s 23.3%.

But 2025 has brought a different kind of challenge to funds and investors alike.

Markets have pulled back, weighed down by talk of tariffs, recession, and global instability. Volatility is here to stay it seems, and many portfolios are slipping into negative territory for the year. In this context, the definition of alpha has shifted — now, staying flat or slightly positive while others are losing ground is a form of quiet outperformance.

At Solimar, that’s exactly what we’re built for. Our goal is to compound capital over the long run by capturing high-probability moves when they come.

We’re not chasing the market — we’re following a disciplined, data-driven strategy that removes emotion from the equation. To us, true alpha isn’t about flashy trades or constant action — it’s about consistency, patience, and knowing that we are in the business of annual returns. There is still a lot of trading left in the year.

That’s an alpha bet worth taking!

Lifetime Performance Comparison: Solimar Fund vs. SPY

We’re including a lifetime performance chart below to provide context for our YTD performance.

Solimar Fund Net Lifetime Performance (10/1/23- 3/31/25): 45.1%

SPY Performance (10/1/23- 3/31/25): 30.9%

Looking Ahead: Navigating with Discipline

Charlie Munger once said, “Success means being very patient, but aggressive when it’s time.”

That core principle is built into the DNA of our system.

At Solimar, we don’t rely on gut instincts or emotional decision-making — we rely on data. Our algorithm is designed to be patient by default, filtering out the noise and avoiding low-probability setups.

But when the conditions align — when the data signals a favorable risk-reward opportunity — the system shifts quickly and decisively. This balance of disciplined restraint and data-driven action is how we aim to preserve capital in tough markets and capture meaningful returns when the time is right. It’s not about guessing — it’s about being ready.

If you’re considering joining Solimar Fund, now is a meaningful moment. Our journey toward $10M in AUM is well underway, and we’re proud to be building this alongside a growing group of thoughtful, long-term investors. If you're interested in learning more about joining our early investors, we’d be glad to connect.

Thank you, as always, for your trust. Here’s to navigating the rest of 2025 with clarity, patience, and purpose.

Enjoy the ride! At the moment that means be patient and trust the statistics.

Geoffrey & Tyler

2by2 Capital LLC | [email protected] | www.2by2Capital.com