A Reflection on Performance

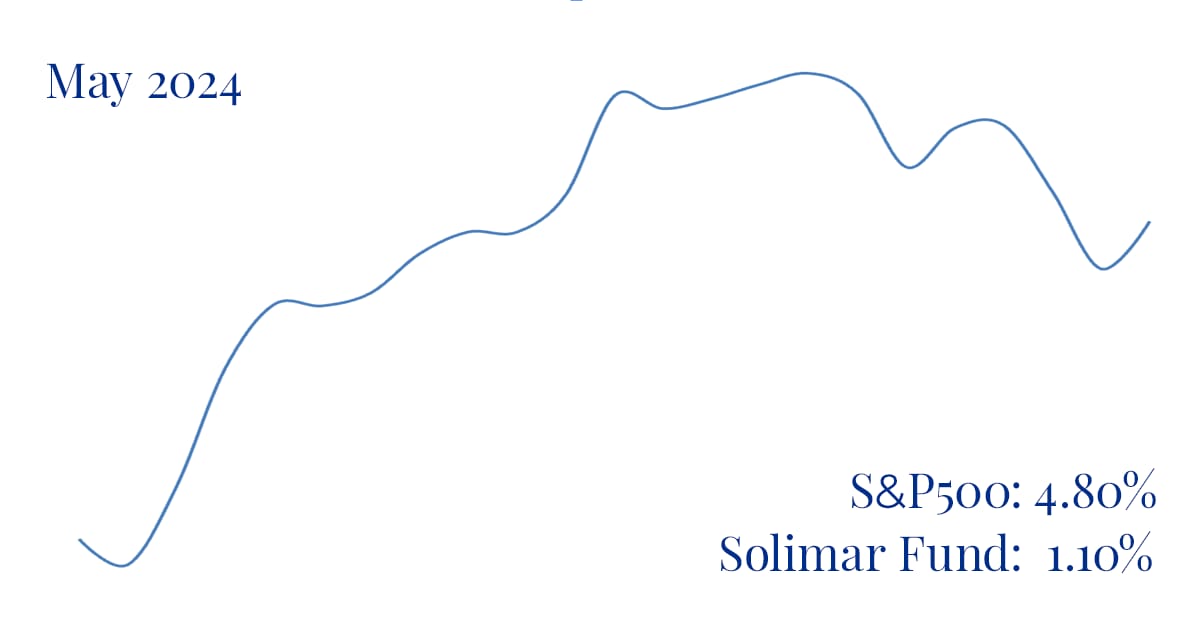

Solimar Fund returned 1.10% net of fees for the month of May compared to the S&P 500’s return of 4.80%. Our YTD return remains solid at 11.70% net of fees compared to S&P 500’s YTD return of 10.64%.

As we look back on our performance in May, we find ourselves reflecting on two months of market under performance. It’s with humble confidence that we keep poking at our system to see if there are any holes. We are reminded that the path to exceptional returns is rarely a straight line.

We continue to delve into new ways to understand and share that confidence with potential investors. This month we’ve bolstered our confidence again with new angles of portfolio analysis to ensure robustness.

Understanding R-Squared: A Measure of Reliability

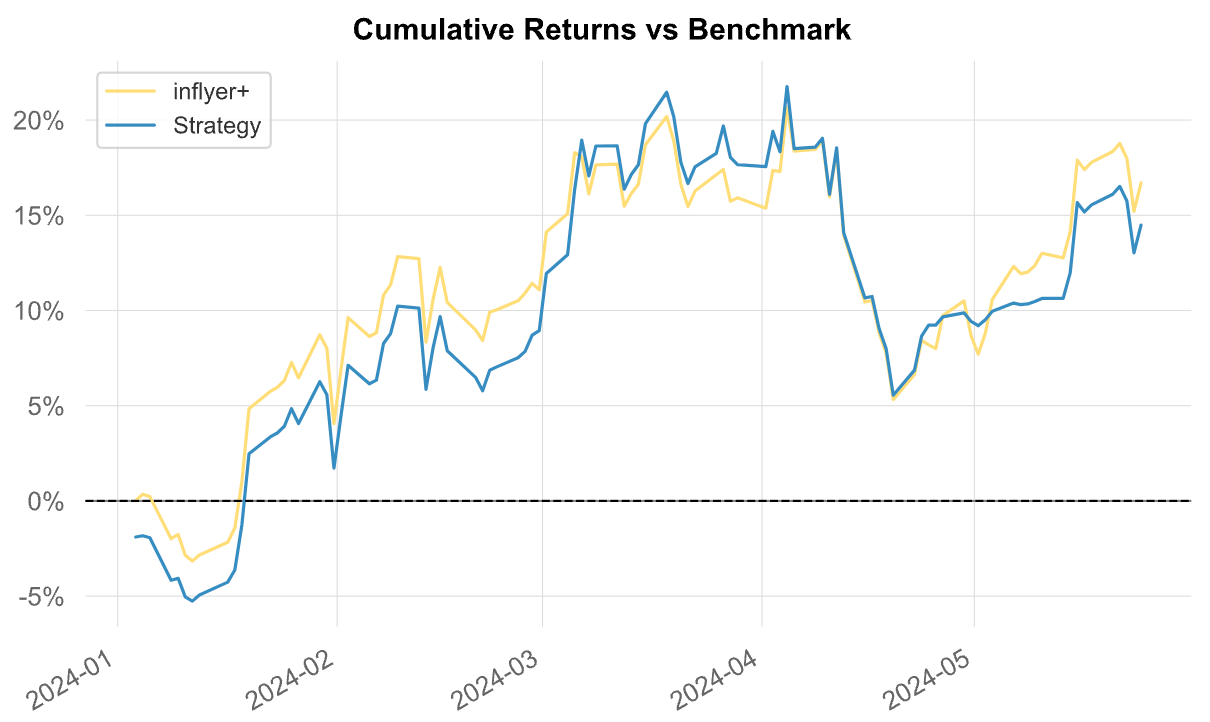

We explored another statistical measure that underpins our confidence: R-squared (R²). R-squared is a statistical measure that indicates the proportion of the variance in a dependent variable that is predictable from the independent variable(s).

In simpler terms, it shows how well our live trading performance correlates with our historical backtested hypothetical data. An R-squared value of 100% indicates perfect correlation, whereas a value of 0 indicates no correlation.

In the first 5 months of 2024, our R-Squared measuring live trading to expected backtest performance year to date is a 91%, just about perfect.

What does that mean? Live trading is expected to mimic our strategy’s remarkable backtested results.

High R-Squared: A Testament to Our Strategy

This strong 91% correlation suggests that our live trading results are closely following our backtested models. Such a high R-squared value is exactly what you want to see when investing in a quantitative system. It signifies that our strategy is sound, our systems are robust, and most importantly our backtested hypothetical returns are replicable.

Impressive Backtested Performance

Backtests are important because they allow us to evaluate how our trading strategy would have performed in the past using historical data through many market regimes. They provide insights into its potential effectiveness and risk profile before deploying the strategy in live markets.

We’ve backtested our strategy through full market cycles, 2007-2024 and 1998-2006, etc. Hypothetical returns and strategy metrics are impressively consistent across 40 years of data. We choose to show our backtested metrics starting on 7/1/2020 because that is when we first started live trading the first version of our algorithm with real money.

Our hypothetical backtest results from 7/1/2020 indicate expected compounded annual returns should exceed 39% net of fees on average over 5 years.

We never just look at expected returns without also looking at expected or potential drawdowns. Over the same period, our strategy’s drawdown was 10% less deep as the S&P 500’s, and 66% shorter in length. While these figures are remarkable and highlight the potential efficacy of our approach, we remain committed to a disciplined and measured outlook.

We recognize that past performance, whether actual or simulated, is not always indicative of future results. We approach these promising findings with a blend of confidence and humility.

Our team is dedicated to continuous refinement and rigorous risk management as we strive to deliver exceptional value for our investors.

On Track for Success

Despite a second month of market under performance, our strategy’s metrics point to outsized performance over 3 to 5 years. In coming months we will discuss additional statistical measurements from our strategy. Our goal is to build your confidence in the rigor of our system and the growth potential of an investment in Solimar Fund.

Thank you for your continued trust and support. We are confident that in time our strategy will yield great returns, and we look forward to sharing our success with you.

Warm regards,

Geoffrey & Tyler

2by2 Capital LLC | [email protected] | www.2by2Capital.com